TSXV:OIII | OTCQX:OIIIF - O3 Mining

TORONTO, Nov. 10, 2022 /CNW/ - O3 Mining Inc. (TSXV: OIII) (OTCQX: OIIIF) ("O3 Mining" or the "Corporation") is pleased to provide a first maiden Mineral Resource Estimate ("MRE") for its 100% owned Bulldog gold deposit at Alpha, Val-d'Or Quebec, Canada.

- Inferred resources of 318,000 oz Au at Bulldog and Kappa

- 76% of drilling completed by O3 Mining since September 2019 on Bulldog and Kappa

- Best intercepts below current Bulldog resource, show potential to expand with future drilling

- 5.3 g/t Au over 3.8 metres in hole O3AL-22-351B-W4EXT - 125 metres below resource, and 4.4 g/t Au over 2.2 metres in hole O3Al-21-387, 250 metres below resource

- Kappa discovery remains open to the east and at depth

O3 Mining President and Chief Executive Officer, Mt. Jose Vizquerra commented, "We are very pleased to be continuing to deliver on all milestones outlined for 2022, starting with our Pre-feasibility study for Marban in September, and now a first maiden MRE for Bulldog and Kappa. These are huge milestones for our team, company, and shareholders. The 2022 drilling campaign on Alpha was focused on expanding the known deposits at Kappa and Bulldog, and this MRE shows there is more room to grow. The continuity of mineralization and the proximity of the Kappa and Bulldog zones creates the potential for a sizeable project with a robust grade, thickness, and continuity."

This MRE includes approximately 50,000 metres of drilling in 116 holes, including 42,817 meters in 88 holes completed by O3 Mining from September 2019 to April 2022. The MRE was independently prepared by G Mining Services in accordance with National Instrument 43-101 ("NI-43-101"), with an effective date of November 10, 2022, and using a database current as of October 7, 2022. The full technical report, which is being prepared in accordance with NI-43-101 will be available on SEDAR (www.sedar.com) under the Corporation's issuer profile within 45 days. Much of the estimated tonnage related to the Bulldog deposit is contained in three stacked zones within a 75-metre-wide corridor starting at surface and covering an area of 620 metres vertical by 360 metres wide. The true thickness of the Bulldog zones varies from 2 to 10 metres. The resources related to the Kappa zones are distributed in two sub-vertical shoots starting at 60 metres and 560 metres vertical, respectively, each covering an area of approximately 200 metres long by 100 metres wide. The Kappa horizon is located 175 metres north of the Bulldog trend.

Table 1: Bulldog Deposit Mineral Resource Estimate (lower cut-off: Au ≥ 1.8 g/t)

|

Category |

Deposit |

Tonnage |

Gold Grade |

Gold Content |

|

kt |

g/t |

koz |

||

|

Inferred |

Bulldog |

2,649 |

3.2 |

270 |

|

Kappa |

403 |

3.7 |

48 |

|

|

Total |

3,052 |

3.2 |

318 |

|

Notes: |

|

|

1. |

The mineral resources described above have been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy, and Petroleum, 2014) and follow Best Practices outlined by the CIM (2019) |

|

2. |

The QP for this mineral resource estimate is James Purchase, P. Geo of G Mining Services Inc. Mr. Purchase is a member of L'Ordre des Géologues du Québec (#2082) |

|

3. |

The effective date of the mineral resource estimate is November 10, 2022 |

|

4. |

Underground mineral resources have been reported using a 1.8 g/t lower cut-off. |

|

5. |

The Bulldog deposit has been classified as inferred mineral resources according to drilling spacing and estimation pass. Underground mineral resources have been categorized manually within a constraining volume to remove isolated areas not satisfying RPEEE, and have been reported using a 2 m minimum thickness. |

|

6. |

There are no known underground workings at the Bulldog Deposit |

|

7. |

The density has been applied based on measurements taken on the drill core, and assigned in the block model by lithology |

|

8. |

A minimum thickness of 2 m was used when interpreting the mineralized bodies |

|

9. |

The MRE is based on subblock models with a main block size of 10 m x 3 m x 5 m, with subblocks of 2.5 m x 0.75 m x 2.5 m |

|

10. |

Tonnage has been expressed in the metric system, and gold metal content has been expressed in troy ounces |

|

11. |

The tonnages have been rounded to the nearest 1,000 tonne and the metal content has been rounded to the nearest 1,000 ounce. Gold grades have been reported to one decimal place reflecting the uncertainty associated with Inferred Mineral Resources |

These mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported inferred mineral resources in this news release are uncertain in nature and there has been insufficient exploration to define these resources as indicated or measured; however, it is reasonably expected that most inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

The QP is not aware of any factors or issues that materially affect the mineral resource estimate other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors, and additional risk factors regarding inferred resources.

The mineral resource was prepared using assays sourced from diamond drilling samples with interval lengths varying between 0.5 m to 1.5 m. Wireframes representing mineralization were produced using a nominal cut-off of 2.0 g/t, with a minimum thickness of 2 m. Assay capping thresholds were chosen based on probability plots and decile analysis and vary between 15 g/t Au for Bulldog, and 40 g/t Au for Kappa. The block model was constructed using 10 m x 3 m x 5 m parent blocks, with 2.5 m x 0.75 m x 2.5 m subblocks. Gold grades were interpolated with 1 m composites using Inverse Distance Squared (ID2) using a four-pass strategy. For Kappa, an additional capping of 10 g/t Au was applied during the interpolation of later estimation passes to restrict the influence of high grades (high-grade restraining). The block model was classified as Inferred category based on the distance to drilling and estimation pass. The block model was reported within a constraining volume to remove isolated blocks above the 1.8 g/t Au lower cut-off that do not satisfy RPEEE requirements (Reasonable Prospect of Eventual Economic Extraction). Table 2 presents the mineral resource at different cut-off grades.

Table 2: Mineral Resource Sensitivity to cut-off grade

|

Category |

Cut-off |

Tonnage |

Gold Grade |

Gold Content |

||

|

g/t |

kt |

g/t |

Koz |

|||

|

Inferred |

1.5* |

3,929 |

2.9 |

366 |

||

|

1.8 |

3,052 |

3.2 |

318 |

|||

|

2.0 |

2,724 |

3.4 |

298 |

|||

|

2.5 |

1,890 |

3.9 |

239 |

|||

|

* Not constrained by reporting volume |

The tonnages and grades at differing cut-offs shown above are for comparison purposes only and do not constitute an official mineral resource.

O3 Mining is currently proceeding with environmental and metallurgical test work on both deposits. Environmental tests will characterize Bulldog and Kappa ore and waste for acid rock drainage (ARD) and metal leaching (ML) upon exposure to ambient conditions and thus, the risk associated with the waste material and subsequent mine waste management practices. These tests aim to simulate weathering under accelerated conditions to verify their respective acidogenic potential and the quality of their drainage in the short, medium, or long term, as well as to assess the potential for the generation of any contaminated drainage. Metallurgical tests will be performed on one composite per deposit to calibrate grinding size and determine gold recovery.

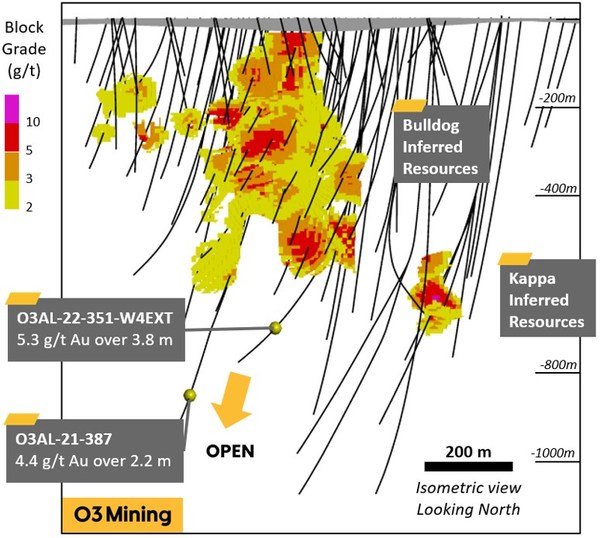

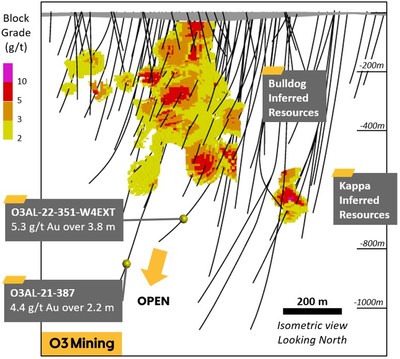

Figure 2: Longitudinal Section

In addition to the current MRE, O3 Mining is reporting intercepts outside of the current MRE that show a potential to expand the resource significantly with future drilling.

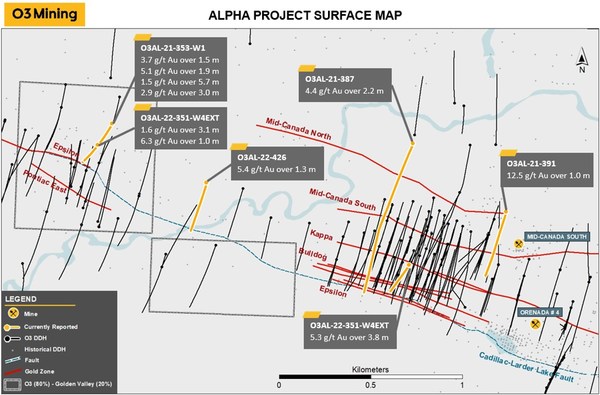

Bulldog

Along the down-dip extension of the Bulldog deposit, hole O3AL-22-351B-W4EXT returned 5.3 g/t Au over 3.8 m, 125 metres below the current resource. Additionally, hole O3AL-21-387 returned 4.4 g/t Au over 2.2 m, 235 metres below the current resource. Both intercepts demonstrate the extension of the Bulldog ore body over a minimum additional 250 vertical metres.

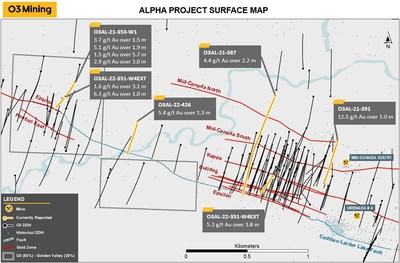

Bulldog trend

Drill hole O3AL-22-426 is located 1,000 metres west of the Bulldog deposit. At 281 metres the hole intercepted a structure that yielded 5.4 g/t Au over 1.3 m in an envelope of sheared and sericitized rocks with mineralization like Bulldog. Sparce drilling in that area offers significant potential to generate additional resources along the Bulldog trend.

Kappa

The Kappa zone was intercepted while stepping back to expand the Bulldog ore body, the deeper Kappa discovery remains open at depth and to the east. The significant percentage of sulfides in this deposit offers the possibility to use hole-to-hole IP to optimize drilling meterage during the delineation of the ore bodies along that trend.

Centremaque Intrusions

Branches O3AL-21-353-W1 and O3AL-21-353-W3 intersected multiple zones of quartz and quartz–tourmaline veining within or near intrusions located north of the Cadillac Larder Lake Fault, a mineralisation style pertaining to the Sigma-Lamaque deposit types. The two branches of the same hole are located 1.6 km west of the Bulldog deposit and 2 km south of the Triangle deposit of Eldorado Gold. These intercepts remain open for expansion laterally and at depth.

Table 3: New Drill Hole Intercepts near Resource Area (only intercepts above 5 g/t Au*m are reported)

|

Drill Hole |

From (m) |

To (m) |

Au (g/t) |

Interval (m) |

Zone |

|

O3AL-22-351B-W4EXT |

843.7 |

847.5 |

5.3 |

3.8 |

Bulldog |

|

O3AL-21-387 |

1118.5 |

1120.7 |

4.4 |

2.2 |

|

|

O3AL-22-426 |

281.7 |

283.0 |

5.4 |

1.3 |

Bulldog West |

|

O3AL-21-391 |

169.0 |

170.0 |

12.5 |

1.0 |

Mid-Canada South |

|

O3AL-21-353-W1 |

682.5 |

684.0 |

3.7 |

1.5 |

Centremaque Intrusions |

|

and |

688.0 |

689.9 |

5.1 |

1.9 |

|

|

and |

878.6 |

884.3 |

1.5 |

5.7 |

|

|

and |

1075.5 |

1078.5 |

2.9 |

3.0 |

|

|

O3AL-21-353-W3 |

1055.5 |

1058.6 |

1.6 |

3.1 |

|

|

and |

1134.0 |

1135.0 |

6.3 |

1.0 |

Figure 3: Alpha Project Surface Map

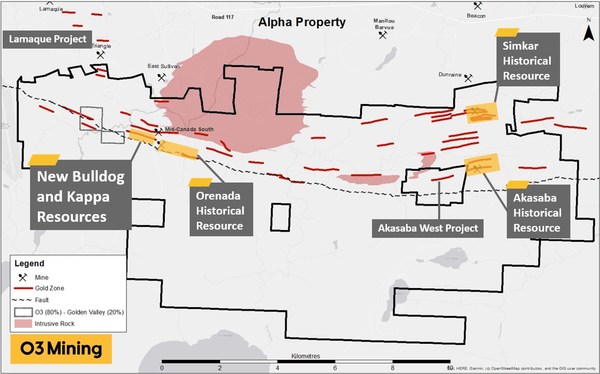

The Alpha property is located eight kilometres east of Val-d'Or, Québec, south of Eldorado Gold's Lamaque Project and also surrounding Agnico Eagle's Akasaba West property. The property covers more than 7,754 hectares and includes 20 kilometres of the prolific Cadillac-Larder Lake Break. The Alpha property hosts historic resources of 0.5 million ounces measured and indicated (7.7 Mt @ 2.0 g/t Au)1 and 0.4 million ounces in the inferred category (4.0 Mt @ 3.1 g/t Au)1.

O3 Mining continues to extend gold mineralization with the potential to increase resources within trucking distance of the 1,400 tpd Aurbel Mill ("Aurbel"). On May 14, 2020, the Corporation signed an option agreement with QMX Gold Corporation (acquired by Eldorado Gold in January 2021) to acquire a 100 percent interest in Aurbel, which is a fully permitted mining facility located 10 kilometres from O3 Mining's Alpha property.

|

1/ Mineral Inventory: i) Orenada Technical Report 2018, ii) Akasaba Technical Report 2014, iii) Simkar Gold Technical Report 2015 |

The scientific and technical information contained in this news release has been reviewed and approved by Mr. Sébastien Vigneau, P.Geo (OGQ #993), Principal Geologist of O3 Mining, who is a "qualified person" within the meaning of NI 43-101.

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zones. Reported assay results are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Half-core samples are shipped to Agat laboratory in Val-d'Or, Québec, and Mississauga, Ontario for assaying. The core is crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 50 g is analyzed by Fire Assay (FA) with an Atomic Absorption Spectrometry (AAS) finish. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge. Commercial certified standard material and blanks are systematically inserted by O3 Mining's geologists into the sample chain after every 18 core samples as part of the quality assurance and quality control ("QA/QC") program. Third-party assays are submitted to other designated laboratories for 5% of mineralized samples. Drill program design, QA/QC, and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices.

O3 Mining Inc., an Osisko Group company, is a gold explorer and mine developer on the road to produce from its highly prospective gold camps in Québec, Canada. O3 Mining benefits from the support, previous mine-building success, and expertise of the Osisko team as it grows towards being a gold producer with several multi-million-ounce deposits in Québec.

O3 Mining is well-capitalized and owns a 100% interest in all its properties (66,000 hectares) in Québec. O3 Mining trades on the TSX Venture Exchange (TSXV: OIII) and OTC Markets (OTCQX: OIIIF). The Corporation is focused on delivering superior returns to its shareholders and long-term benefits to its stakeholders. Further information can be found on our website at https://o3mining.com

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

SOURCE O3 Mining Inc.